Challenging to Obtain Growth Capital.

Emerging companies with $3M – $50M in annual revenue find it challenging to obtain business friendly growth capital in the $1M – $5M range to expand their business. Most banks prefer to lend working capital, not pure growth capital. According to the Bank Administration Institute, more than 30,000 commercial loan applications are declined every day in the United States.

Private Debt is Expensive and Cumbersome.

It’s typically high interest, requires collateral, personal guarantees, warrants, rigid terms and payment schedules, along with default provisions that can lead to foreclosure.

Private Equity is Difficult to Obtain

PE requires a rigorous vetting process. Private equity investors considering expansion stage companies are typically looking to invest $20M or more, and are seeking a 10x return via an exit strategy usually within 5 years

The Solution: Royalty Based Finance

RBF is an innovative new source of growth capital for businesses with annual revenue of $3M +. It fits between debt and private equity.

BUSINESS FRIENDLY GROWTH CAPITAL:

Royalty Based Finance is business friendly growth capital for emerging companies to expand their business and increase the value of their company without sacrificing equity, or taking on cumbersome debt.

Owner and Investors Interests Are Aligned:

Both owner and investor are focused on revenue growth. There are no restrictive financial covenants, inflexible monthly payments, default provisions, collateral or personal guarantees required. Private equity investors are focused on performance guarantees, management control and an exit strategy. With RBF both the owner and investor are free to focus on growing the business.

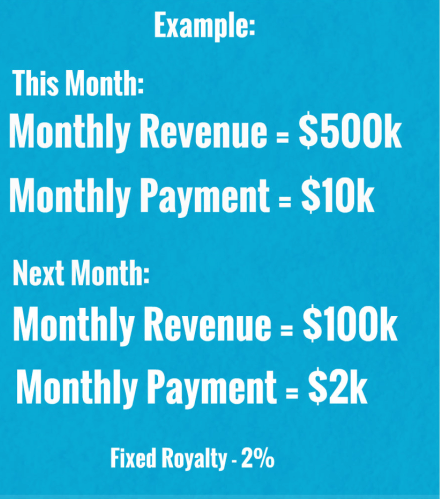

Flexible Monthly Payments:

Monthly payments rise and fall with revenue. Unlike traditional debt, the payment plan is flexible and adapts to your business model. Cash flow friendly RBF is aligned with your top-line revenue targets. You are not penalized for slow months or seasonal circumstances.

No Restrictive Financial Covenants:

Unlike debt, there are no restrictive financial covenants, inflexible monthly payments, rigid terms, default provisions, or hard collateral. No need for joint creditors; compliments pre-existing debt agreements

Retain Ownership:

You are able to raise growth capital and keep 100% of your equity. No pre-money valuation required. There is no risk of dilution or requirement for warrants. Benefit from all the value you produce.

Retain Control of Your Company:

No board seats or governance requirements that could limit your control of the business. Use the capital to run the business as you see fit.

No Personal Guarantee:

Protect your personal wealth. Your personal and business interests are kept separate.

No Exit Strategy Required:

Mutual success is based upon revenue growth. Does not require a liquidity event for success

Flexible Monthly Payments

Royalty Based Finance is business friendly growth capital for emerging companies to expand their business and increase the value of their company without sacrificing equity, or taking on cumbersome debt.