Grow Your Business without Giving the Farm Away

Suppose you have built a technology driven service company that has been in business for 5 years and is billing $12 million per year.

Your business plan proves that you can triple the revenue in 5 years with $1 million dollars of growth capital. Growth can be organic, and or acquisition.

But, you don't want or can’t qualify for a bank loan or Venture Capital. Additionally, you want to retain your equity along with your control of the company, and you don't want to take on cumbersome debt.

WHAT ARE YOUR FINANCING OPTIONS?

1.VENTURE CAPITAL:

After a rigorous process, investors take an equity position. You agree upon the following:

Valuation:

You and the equity investor need to agree upon a valuation. Your EBITDA is $1.2 million, the VC decides to value your company at 6x EBITDA - $6,120,000. A $1 million growth capital investment will give the VC about 17% ownership of your company and leave you with 83%.

Conditions:

Additionally, the VC demands a board seat, monthly performance milestones, a personal guarantee and other conditions. Exit strategy - the company will be sold in 5 years.

Risk:

If you are having trouble hitting the monthly milestones you may lose control, equity and possibly personal wealth.

Reward:

If you hit your plan, at the end of 5 years your company will have:

- $36 million annual revenue:

- 20% EBITDA = $7.2 million

- Valuation of 8x EBITDA = $57.6 million

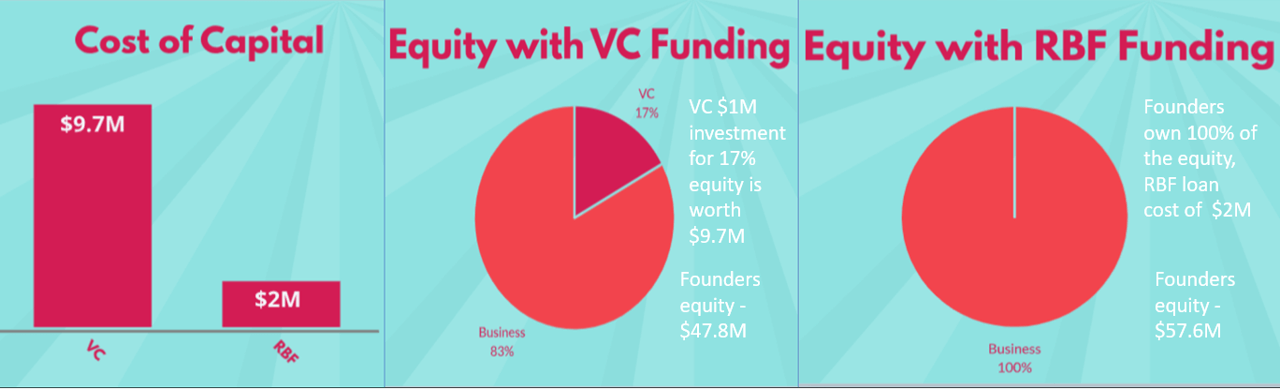

- VC Equity = 17% = $9.7 million cost of capital. Nearly 10x return to VC

- Your Equity = 83% = $47.8 million

The VC made $9.7M on their $1M investment. If you had kept your equity, the $9.7M would have been yours. Your cost of capital was $9.7M.

2.ROYALTY BASED FINANCING:

Investor Takes Small % of the Monthly Revenue Until the Debt Is Paid. You agree upon the following:

Valuation:

Valuation:

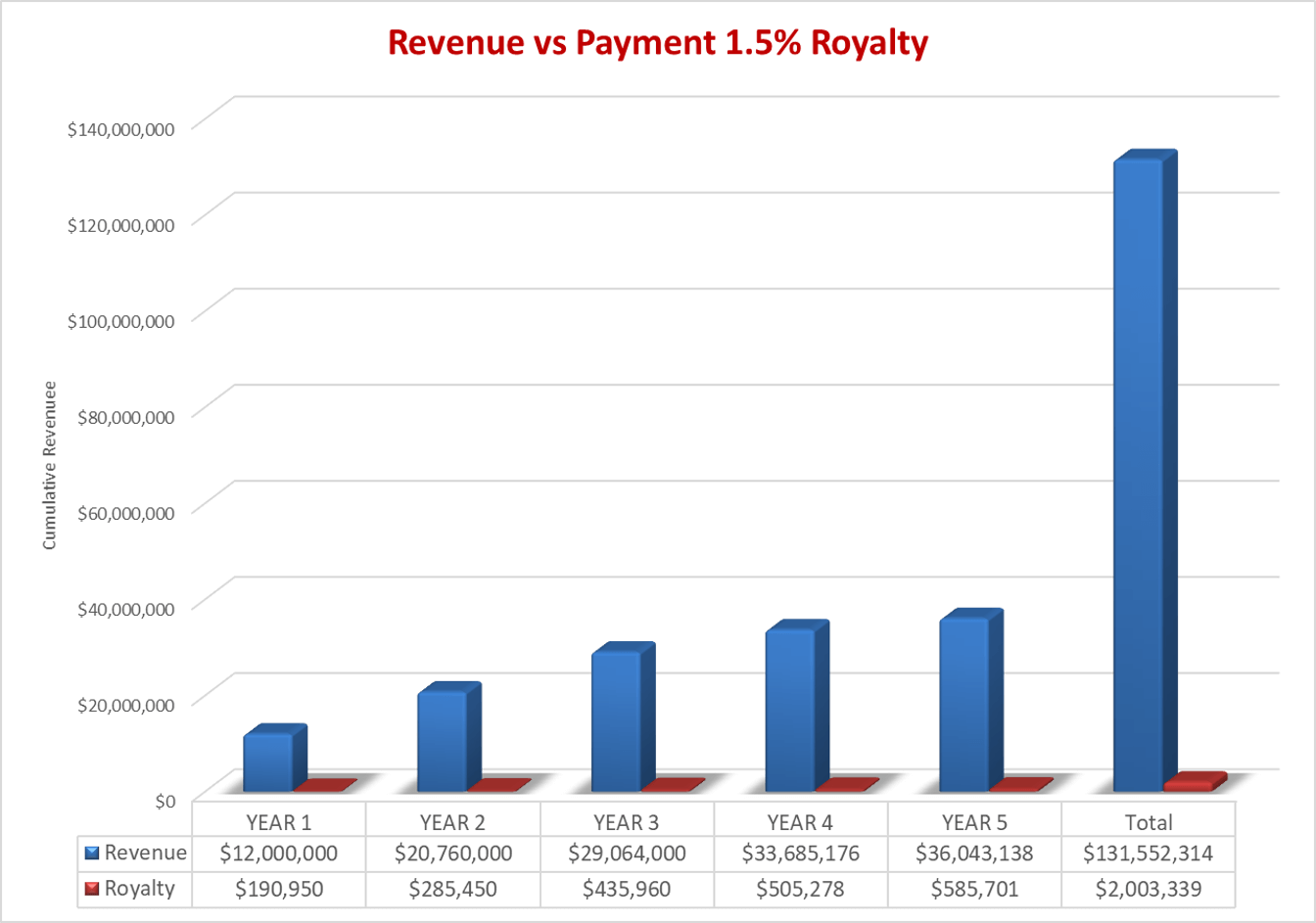

Not necessary. In this case, you and the investor mutually agree that you will pay the investor 1.5% of your monthly revenues until the investor receives $2 million (2x return).

Conditions:

No equity, board seat, control issues, monthly performance milestones, personal guarantee or other conditions. No exit strategy. Revenue growth equals mutual success.

Risk:

In this example, only requirement is to pay 1.5% of the monthly revenue until the debt is paid. If revenue increases the payment increases, if revenue decreases the payment decreases. No threat of losing equity, control, personal wealth.

Reward:

If you hit your plan, at the end of 5 years your company will have:

- $36 million annual revenue

- 20% EBITDA = $7.2 million

- Valuation of 8x EBITDA = $57.6 million

- Royalty Based Financing cost of capital = $2 million. 2x return to investor

- Your Equity = 100% = $57.6 million

Unlike with the VC, you retained 100% of your equity. Your cost of capital was the $2M paid for the RBF loan. Cost of capital with the VC was $9.7M.

Difference:

In this scenario, the cost of capital for the $1M investment from the VC was $9.7M. The cost of capital for the same investment from the Royalty based finance alternative was $2M.

It cost almost 5x more to take the VC money. Additionally, with RBF, you keep 100% of the equity and retain control of the company.

Summary

The Royalty Based Finance (RBF) option eliminates the complex, time consuming rigorous process to find VC financing. With RBF financing, you fill out an application, the investor evaluates your financials, track record and business plan to verify that you can meet the flexible monthly percent of revenue payments.

You and the investor mutually agree upon a fixed payback amount (royalty cap). The royalty cap obligation is usually met within 4 to 6 years. You are both successful if you meet your growth plan.