How to Make More Money with Royalty Based Finance.

Royalty Based finance is an innovative new source of alternative growth capital. Above all, it is capital that will enable you to expand your business and make more money. It takes money to make money.

Successful small to mid-sized companies start with a great idea, working capital and hard work to reach success.

But, they need growth capital to expand their business. For example, with growth capital companies can hire more sales people, launch new products, expand into new markets or acquire companies.

It can be difficult and expensive for a small to mid-sized business to obtain growth capital. Their choices are traditional debt or venture capital.

If a lender is willing to loan growth capital they will require personal guarantees and hard collateral. Also, they will impose restrictive financial covenants, and enforce a strict repayment. Consequently, these requirements can lead to foreclosure.

Looking for venture capital is a long, cumbersome process. If you can get VC you will sacrifice equity, give up control, risk dilution and be forced to focus on a short term exit strategy.

Good news! Royalty Based Finance is an innovative alternative to traditional funding.

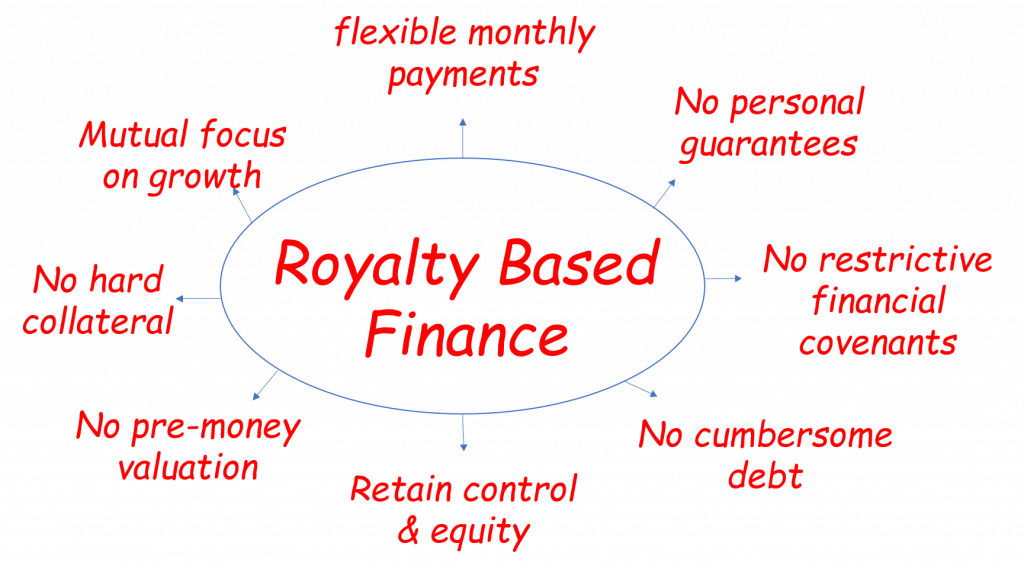

Royalty based finance provides growth capital in exchange for a small percentage of your monthly top line revenue, usually between 1% to 5%. (Infographic)

With Royalty Based Finance there are no personal guarantees and you keep 100% of your equity. Flexible monthly payments are tied to revenue, you don’t give up board seats and you maintain control of your company.

Grow your company and make more money with Royalty Based Finance. Royalty Based finance is an innovative new source of alternative growth capital. (Investment Criteria Infographic)