It's Challenging for Small to Mid-Sized Businesses to Obtain Growth Capital.

Choices Are Expensive/Cumbersome Debt, Or Private Equity.

-

ROYALTY BASED FINANCE...

INNOVATIVE NEW SOURCE OF GROWTH CAPITAL:

Royalty-based finance has been used for decades in oil & gas, mining and health care. Our firm is an intermediary (Not a Fund) providing growing companies access to business friendly growth capital

Designed for established companies with $3M - to $50M annual revenues seeking $1M to $3.5M growth capital funding

-

BUSINESS FRIENDLY GROWTH CAPITAL:

Royalty Based Finance is business friendly growth capital for emerging companies to expand their business and increase the value of their company without sacrificing equity, or taking on cumbersome debt.

-

HOW IT WORKS - ALTERNATIVE TO PRIVATE EQUITY & DEBT:

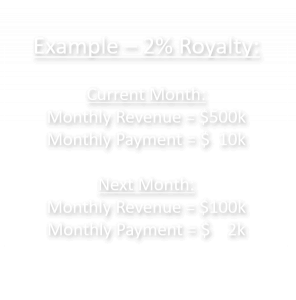

Growth capital is provided in exchange for a fixed percentage (1% to 5%) of your monthly top line revenue. Flexible monthly payments rise and fall with revenue. Flexible payments continue until the initial capital plus a pre-determined amount is repaid.

-

BENEFITS:

Unlike traditional debt, there are no restrictive financial covenants, hard collateral or personal guarantees. Flexible monthly payments are cash flow friendly. Additionally, no equity position is taken; you retain ownership and control of your company.

-

CAPITAL TO GROW YOUR BUSINESS:

Without the constraints of private equity or traditional debt, you are free to focus on growing your company. Designed for companies with $3M - to $50M in annual revenue seeking $1M - $3.5M in growth capital.