Royalty Based Financing Features

Royalty Based Finance is an innovative new source of growth capital for emerging companies to expand their business and increase the value of their company without sacrificing equity, control, or taking on cumbersome debt.

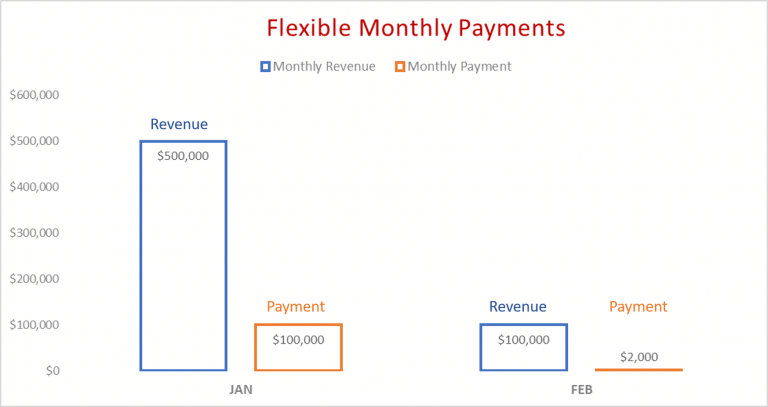

Growth capital is provided in exchange for a fixed percentage (1% to 5%) of your monthly top line revenue. Cash flow friendly flexible monthly payments rise and fall with revenue. Flexible payments continue until the initial capital plus a pre-determined amount is repaid.

-

Flexible Monthly Payments

Monthly payments rise and fall with revenue. Unlike traditional debt, the payment plan is flexible and adapts to your business model.

-

Retain Ownership & Control

There are no board seats or governance requirements that could limit your control of the business. Consequently, you can use the capital to run the business as you see fit and keep your equity.

-

Mutual Focus on Revenue Growth

Success for both the owner and investor is revenue growth – not the eventual sale of the company. Exit strategy not required.

-

Flexible Terms

No hard collateral, performance/personal guarantees, rigid terms/payments, restrictive financial covenants, default provisions etc.

-

Protect Personal Wealth

No personal guarantees required. No need to risk your personal wealth.

-

Compatable with Debt & Equity Agreements

No need for joint creditors-compliments pre-existing debt agreements. Compatible with VC and debt financing - increase company valuation

Flexible Monthly Payments:

Slow Months or Seasonal Circumstances Don't Drain Cash