NEED CAPITAL TO GROW YOUR BUSINESS?

ROYALTY BASED FINANCE

It’s Challenging for Small to Mid-Sized Businesses to Obtain Growth Capital.

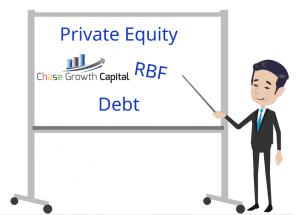

Choices Are Expensive/Cumbersome Debt, Or Private Equity.

CAPITAL TO GROW YOUR BUSINESS:

Without the constraints of private equity or traditional debt, you are free to focus on growing your company. Designed for companies with $3M – to $50M in annual revenue seeking $1M – $3.5M in growth capital.

ROYALTY BASED FINANCE…

INNOVATIVE NEW SOURCE OF GROWTH CAPITAL:

Royalty-based finance has been used for decades in oil & gas, mining and health care. Our firm is an intermediary (Not a Fund) providing growing companies access to business-friendly growth capital

Designed for established companies with $3M – to $50M annual revenues seeking $1M to $3.5M growth capital funding

BUSINESS FRIENDLY GROWTH CAPITAL:

Royalty Based Finance is business friendly growth capital for emerging companies to expand their business and increase the value of their company without sacrificing equity, or taking on cumbersome debt.

HOW IT WORKS – ALTERNATIVE TO PRIVATE EQUITY & DEBT:

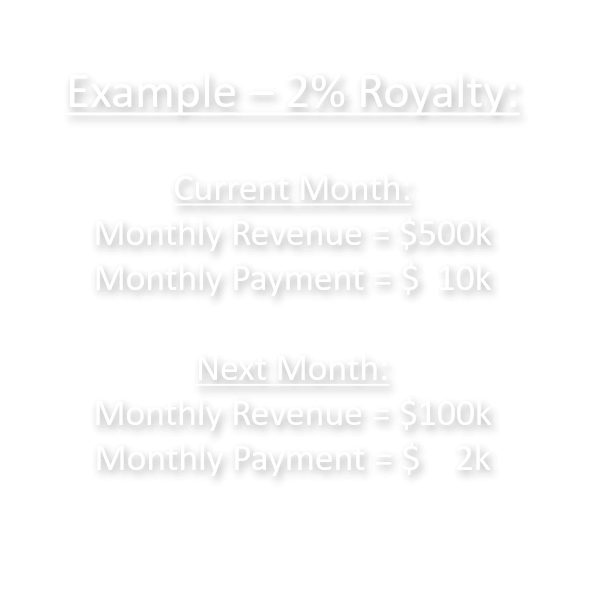

Growth capital is provided in exchange for a fixed percentage (1% to 5%) of your monthly top line revenue. Flexible monthly payments rise and fall with revenue. Flexible payments continue until the initial capital plus a pre-determined amount is repaid.

BENEFITS:

Unlike traditional debt, there are no restrictive financial covenants, hard collateral or personal guarantees. Flexible monthly payments are cash flow friendly. Additionally, no equity position is taken; you retain ownership and control of your company.

Royalty Based Financed is Positioned Between Debt and Equity.

The Monthly Royalty Payment is Fixed at 1% – 5% of the Monthly Revenue.

Royalty Based Finance Articles:

3 Tips for Securing RBF

1.Proven Growth Plan in Place. Investors need to see a clearly defined, proven sales process in place that demonstrates how and when you will hit your aggressive revenue growth forecast, along with 2 years of solid historical financial documentation. Ideally, your revenue…

Business Friendly Growth Capital

Challenging to Obtain Growth Capital. Emerging companies with $3M – $50M in annual revenue find it challenging to obtain business friendly growth capital in the $1M – $5M range to expand their business. Most banks prefer to lend working capital, not pure growth capital. A…

How to Grow Your Business and Keep Your Equity

Suppose you have built a technology driven service company that has been in business for 5 years and is billing $12 million per year. Your business plan proves that you can triple the revenue in 5 years with $1 million dollars of growth capital. Growth can be organic, and…