What is Royalty Based Financing? (RBF)

Royalty Based Financing (RBF) is an innovative new source of growth capital. Emerging companies can expand their business and increase the value of their company without sacrificing equity, or taking on cumbersome debt. (Getting Capital through Royalty Based Financing)

Royalty Based Finance eliminates the need for venture capital or bank debt. Growth capital is provided in exchange for a fixed percentage (1% to 5%) of your monthly top line revenue. Unlike private equity, the business owners retain ownership and control of their company.

How Does RBF Work?

- Growth capital is provided up-front in exchange for a percentage of a company’s monthly top-line revenue.

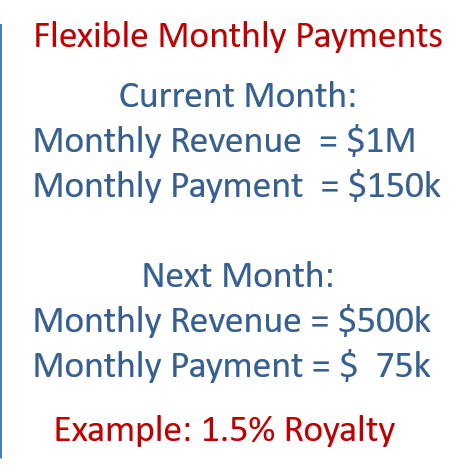

- The royalty rate is typically fixed at 1-5% of the top-line revenue

- Flexible payments rise and fall with revenue

- Royalty payments are structured to last for about 4 to 6 years and range from $1M to $3.5M per company.

- The payments continue until the capital plus a predetermined amount is repaid.

Benefits of RBF:

- Retain 100% ownership and control

- Cash flow friendly payments rise and fall with revenue

- No restrictive financial covenants

- Personal guarantees not required

- Hard collateral not necessary

How Much Growth Capital Can We Get?

- Typically between $1M and $3.5M

What is the Qualifying Criteria for RBF?

- Approximately $3M-$50M annual revenue

- Market-proven product or service, 3 year operating history

- Substantial growth opportunities, i.e. expand sales/marketing, acquisition, geographic expansion, new product launch, etc.

- Gross margin in excess of 30%

- Detailed sales process and plan in place to hit sales growth forecast

- Proven management team

Smart Growth Capital

BENEFITS OF ROYALTY BASED FINANCE:

No Exit Strategy Required Payment is Fixed % of Revenue Off Balance Sheet Flexible Monthly Payments No Financial Covenants Fits with Pre-Existing Debt No Hard Collateral No Pre-Money Valuation

Focus is Revenue Growth