It Can be Challenging to Obtain Growth Capital

It is challenging for emerging companies with $3M to $50 in annual revenue to obtain growth capital . They typically need $1M to $3M for business expansion. But, most banks prefer to lend working capital, not pure growth capital. Per the Bank Administration Institute, more than 30,000 commercial loan applications are declined every day in the United States.

Private debt requires high interest rates, hard collateral, personal guarantees and warrants. Additionally, there are inflexible terms and payment schedules along with default provisions. These conditions can lead to foreclosure. As a result, private debt is expensive and cumbersome.

Private equity is dilutive, difficult to obtain and requires a rigorous vetting process. Private equity investors considering expansion stage companies are typically looking to invest $20M plus. Additionally, they want a strong say in management. Consequently, they focus on an exit strategy with a maximum return. The owners and investors goals are not in alignment. Flexible, Royalty Based Finance is a unique solution for owners and investors seeking long term growth.

Royalty Based Finance: Business Friendly Funding Solution

Royalty Based Finance or (Revenue Based Finance) has been used for decades in oil & gas, mining and health care. It is now available to businesses in various industries. Royalty Based Finance is an innovative new source of growth capital. It allows emerging companies to expand their business and increase the value of their company without sacrificing equity or taking on cumbersome debt.

How Does Royalty Based Finance Work?

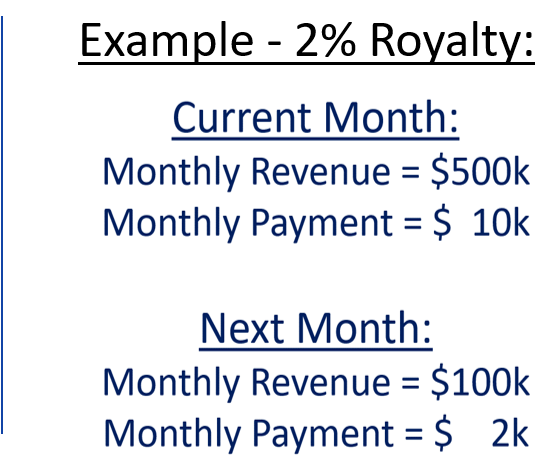

Royalty Based Finance eliminates the need for private equity or bank debt. Growth capital is provided in exchange for a fixed percentage (1% to 5%) of your monthly top line revenue. Unlike private equity, the business owners retain ownership and control of their company.

The monthly payment is variable because the royalty rate is fixed. For example, if the company bills $500k and the fixed royalty rate is 2%, the payment for that month is $10k. If next month's revenue drops to $100k, the royalty payment is $2k. Unlike traditional debt, the payment plan is flexible and adapts to your business model. Cash flow friendly RBF is aligned with your top-line revenue targets. You are not penalized for slow months or seasonal circumstances.

Royalty payments are structured to last for about 4 to 6 years. Capital provided ranges from $1M to $3.5M per company. Flexible payments continue until the initial capital plus a predetermined amount is repaid.

Business friendly features include:

- flexible monthly payments, no interest rate or fixed loan period

- no restrictive financial covenants, warrants, collateral, default provisions, rigid terms/payment structure

- no personal guarantees or FICO score required

- keep 100% of your equity, no pre-money valuation or exit strategy

- no board seats or management control required

- up to $3.5M in growth capital

- compatible with pre-existing debt

How Can Royalty Based Finance be Used?

Royalty based finance provides growth capital for you to use as you see fit. Some examples include:

- capital to grow your business without sacrificing ownership and control, or taking on cumbersome debt

- bridge financing to grow your company and increase valuation for future funding

- expand sales/marketing

- acquisition for rapid growth

- geographic expansion

- cut inventory costs by ordering larger quantities

- new product launch and more

What are the Benefits?

- retain 100% of your equity and total control of the company

- unlike debt, assets are not tied up or exposed to foreclosure

- success for both the owner and investor is revenue growth – not the eventual sale of the company

- cash flow friendly flexible monthly payments – payments rise and fall with revenue

- designed to increase revenue and valuation of the company

- no need for joint creditors-compliments pre-existing debt agreement

What are the Qualifying Criteria?

- approximately $3M – $50M annual revenue

- market-proven product or service, 3-year operating history

- substantial growth opportunities. For example, expand sales, acquisitions, new product launch, etc.

- gross margin in excess of 30%

- detailed sales process and plan in place to hit sales growth forecast

- proven management team that values their equity