Royalty Based Finance is an innovative new source of growth capital for emerging companies to expand their business and increase the value of their company without sacrificing equity, or taking on cumbersome debt.

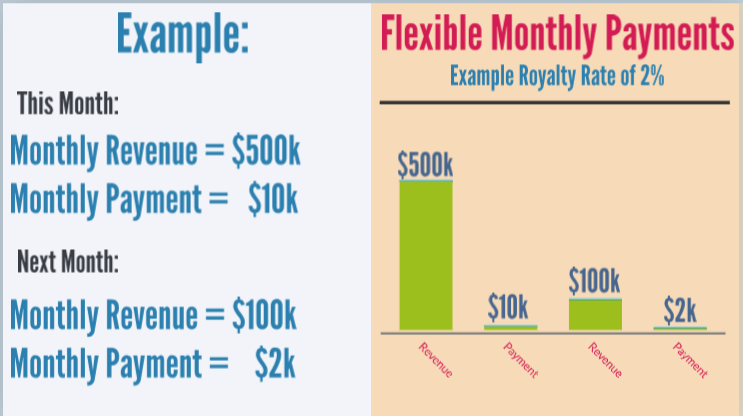

Growth capital is provided in exchange for a fixed percentage (1% to 5%) of your monthly top line revenue. Cash flow friendly flexible monthly payments rise and fall with revenue. Flexible payments continue until the initial capital plus a pre-determined amount is repaid.

Highlights:

-

Flexible Monthly Payments

Monthly payments rise and fall with revenue. Unlike traditional debt, the payment plan is flexible and adapts to your business model.

-

Retain Ownership & Control

Business owner does not sacrifice equity or give up control of the company. No board seat required.

-

Mutual Focus on Revenue Growth

Success for both the owner and investor is revenue growth – not the eventual sale of the company

-

Flexible Terms

No collateral, performance/personal guarantee, rigid terms/payments, default provisions etc.

-

Protect Personal Wealth

No personal guarantees required. No need to risk your personal wealth.

-

Compatable with Debt & Equity Agreements

No need for joint creditors-compliments pre-existing debt agreements. Compatible with VC and debt financing - increase company valuation